Strategic Analysis of Distribution Channels in Brazil

Search Fundação Dom Cabral points profound changes in the transport and distribution Brazilian system

The Strategic Analysis of Distribution Channels survey, conducted by the Center for Logistics and Supply Chain Dom Cabral Foundation, pointed out the main elements of strategic management of distribution of major retailers and wholesalers in the country, business channels to analyze the flow of final products manufacturer to consumer. One of the main conclusions is that the market demands trigger profound changes in the Brazilian transportation and distribution system.

In the modern world, the business environment points to a path of strategic review that unequivocally expand the environment of corporate decisions to a level of business relationships that go beyond the boundaries of the firm. In this way, being competitive demand to understand the company’s position in one or more supply chains, composed of islands not only of production but of groups of supplies and consumables (ie, suppliers and customers), for which success is directly related to the degree of integration of all elements of these ranges. In the dimension of quality requirements, there is a great concern to ensure efficient flow of products and services, from the supply of inputs (upstream industry) to final distribution (downstream industry). Specifically, management of distribution networks has been the subject of constant analysis, in order to reach a production structure that ensures the viability of commercial transactions which are modeled on flows of products and information with the goal of sustained competitiveness. Here, there is a permanent quest to create an efficient channel that respects the characteristics of the economic sectors, so that there is a continuous interaction between members of supply chains. Aspects are considered by firms in training and development of its distribution channels that constitute the core of this work titled Strategic Analysis of Distribution Channels, conducted by the Center for Logistics and Supply Chain Fundação Dom Cabral, between September 2005 and October 2006. structuring of the questionnaire aimed to include the main elements of strategic management of distribution channels. The sending of the questionnaires was based on a study of the Economic Value (2005) which established a revised ranking of the thousand largest Brazilian companies on the billings in 2004. Was not intended to investigate manufacturers of capital goods or extraction of character, since the focus of research was the analysis of the flow of final products from the manufacturer to the final consumer, possibly mediated by retailers and wholesalers. Moreover, the target audience for sending questionnaires consisted of professionals, mostly connected with logistics / distribution, sales, supplies, production and marketing. It was assumed that they would have greater technical and strategic knowledge on corporate positioning with respect to distribution channels in which they operate. In all, 102 companies of the largest distribution channels in Brazil were sampled, especially when investigating the role of collaborative techniques in structuring and developing relationships between retailers, wholesalers and manufacturers. The sectors were surveyed, mainly, those who sell finished products to wholesalers and retailers or directly to individual products. The food and beverage companies make up the largest percentage, with approximately 26% of representativeness, followed by manufacturers of machinery and equipment (10%), furniture (8%) and building materials (7%). Based on Brazilian standards for billing, there is a significant sample group of one thousand largest companies operating in Brazil since 48.1% represent companies with more than 500 million dollars a year turnover. The states of São Paulo, Minas Gerais and Rio Grande do Sul are the ones who have more participants, reaching almost 67% of the total. Although less representative, the Northeast, in turn, is primarily represented the state of Bahia, with nine companies in total (8.8%). Finally, a large portion of the companies surveyed have as main market for Brazil, with 67.7% of the total with operations nationwide, 7.8% and 6.9% regional state. Predominantly exporting companies are therefore a minority, reaching only 17.7% of respondents.

Initial characterization of Brazilian distribution channels

Basically, the type of distribution channel used determines the way in which the products of any company are distributed. As an example, shorter channels favor the closest contact with the customer, thus diminishing the distortionary effects of demand data, improving communication and information exchange with the target market. Moreover, the role of intermediaries such as wholesalers and retailers can be extremely useful in expanding the reach of the company’s distribution, the risk of storage and sharing to conquer new consumer markets. Regarding the use of retailers and wholesalers in the distribution processes in Brazil, one can extract interesting data with respect to the proportion of utilization. Figure 1 shows that only 31.9% of all configurations of the distribution channel used by Brazilian companies figure the retailer is present. Similarly, only 20.8% have the figure of a wholesaler as an intermediary.

On the other hand, direct distribution is present in 61.8% of cases, considering, beyond the direct selling itself, the arrangements for the export market, selling to the government, selling to our own distribution center and customer. In other words, there seems to be a general movement toward rapprochement of businesses with their customers through the elimination of intermediaries in the distribution of products in Brazil. The importance of retailers and wholesalers in Brazil can turn on the constant modernization of distribution logistics practices. As an example, the advent of electronic commerce as an enabler of lean procurement policies and meet the market demands. Companies that previously had no infrastructure for transport and storage obtained through the electronic channel one before disclosure impossible to achieve projection. From there, it eliminates the formation of unnecessary inventory and provides the possibility to hire logistics operators who deliver products based on actual demand data.

Strategic management of distribution channels Brazilians

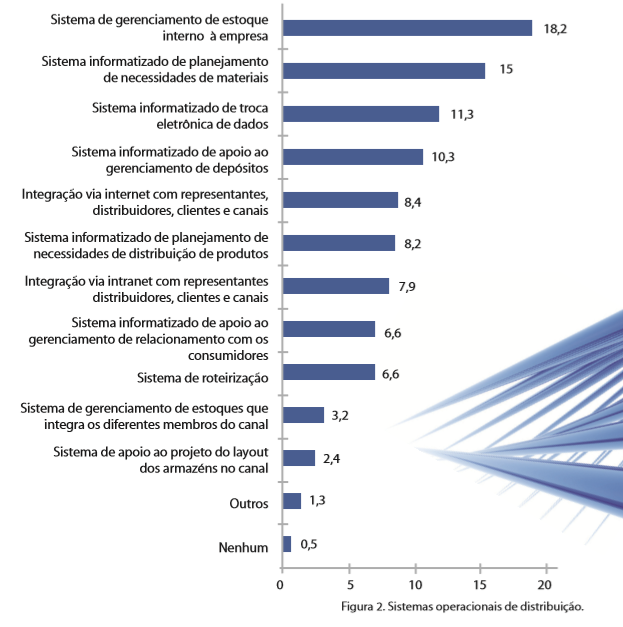

The second part of the general findings of the study presented points of extreme importance in the establishment and development of relations between partners in the Brazilian distribution channels. It was identified that the majority of businesses in the studied distribution channels consists of a history of trade relations, indicating a preference for the practice of keeping agreements and lasting relationships rather than single transactions. Moreover, it was found that the power to concentrate on the decision in retail distribution strategies tends to be adopted to create larger than in the case where the manufacturer controls the channel conflict environment. As an example, in southern Brazil, where the retail proven to be more active and influential, found higher means on the perception that there is a scenario in which major divergence between the partners companies. In order to avoid this type of situation, the integration of members of the distribution channel can provide a greater alignment between strategic plans of each company, thus generating an increase in overall operational efficiency. Altogether, 82.4% of the surveyed companies strive to seek the integration of distribution channel in which they operate. However, systems of control and management of transport and storage in Brazil are more focused on the internal control in material handling companies, rather than prioritizing the integration of distribution channels as a whole. Consequently, the use of tools of information technology such as the internet, intranet and EDI (Electronic Data Interchange) have great potential for growth. Similarly, routing and customer relationship systems can be implemented more intensively. Figure 2 presents the main results with respect to the systems used for control of distribution operations. The potential for the exchange of information can bring to the distribution network involves gains in cost, speed, flexibility and operational efficiency. However, it is not always easy to ensure that these functions are consistent among all channel members. Differentiated batch or attempts to bargain on the price charged for the product may be political factors that destabilize the harmony of the partnership. For such an occurrence is avoided, would need an alignment between the expectations of results to be obtained between members of distribution channels, to consequent further strategic alignment. It should be noted that 65% of respondents are still in a stage of medium or lower level of integration. Ie, there is plenty to evolve accordingly in Brazil. Finally, most respondents (78.4%) invests in the exchange of information with its partners. However, 60% of the sample still claim that there is at least a medium to high level of restrictions on the exchange of information between the channel members. Constraints can be probably caused by lack of confidence, lack of a collaborative relationship, the incompatibility of communication systems among other elements that inhibit information sharing.

Final discussion

The results of this research surprised by the clarity with which positions the strategic development of distribution channels in Brazil were raised by respondents. Increasing demands for shorter delivery times, compliance with deadlines, lower operating costs and improved customer service contribute to triggering profound changes in the Brazilian transportation and distribution system. Resuming the discussion on collaboration in distribution channels as a facilitator of integration among member companies, we find an even field large enough that advances are made . Both direct sales and other forms of product distribution must be guided by policies that favor the win-win relationships, operational integration, strategic alignment and greater emphasis on the exchange of information between customer and company. From there, the foundations for sustainable development strategies focused on reducing costs and increasing the added value to the customer, including at the international level will be – have.

Source: Mundo Logística Magazine